Guaranteed Lifetime Retirement Income

Even if The Stock Market Crashes...

(Create your own pension!)

Do you know what the most dangerous part of climbing Mt. Everest?

Approximately 800 people attempt to climb Everest annually. On average, around five climbers die every year...ON THE DESCEND.

Your retirement money is like climbing Mt. Everest. You work so hard to build and climb to the peak.

Putting all your attention on getting the most growth and taking some risks.

But when you finally are ready to just chill and enjoy the latter part of your life...

That nest egg you've worked so hard to save can easily be decimated in a short period of time from things like...

- Taking income during a market downturn.

- You or your spouse needing extra long-term care.

- Your retirement money running out forcing you to live under your means.

An annuity is a financial contract that provides a steady and guaranteed stream of income during retirement...

No matter how long you live, what happens to the stock market and helps you avoid financial depletion.

It allows you to convert a portion of your retirement into reliable guaranteed lifetime payments with a long-term care component.

The Hidden Retirement Pit Fall That No Body Talks About...

In early 2020, the world changed due to the COVID-19 pandemic, which hit our country on the world as a whole.

COVID-19 created unprecedented challenges and yes, affected the financial market greatly.

On February 19, the SNP peaked at 3386 and in just 33 short days, it dropped nearly 40% down to 2237.

To demonstrate the impact of a 40% loss, let's look at some simple numbers.

If you had $1000 in the market and lost 40%, you would now have $600.

-What would it take to get back to where you started?

Most would think just 40% however,600 times 40% equals $240.

That only gets you back to $840. so you would need more than 40%.

-It's actually 66.6% just to get back to where you started.

What if you had something in place that would keep your money from dropping into these negative numbers?

Even a 0% loss would be better than a 40% loss in such a case, zero really would be your hero the equivalent of the 66.6% necessary to get back to where you started.

For many, COVID represented unprecedented times, but for the stock market, that was not the case.

To see another example, we only have to look at the subprime mortgage and credit crises of 2007.

On October 9th of that year, the S&P peaked at 1565 and over the next 517 days, it dropped nearly 57%.

These are just a few examples of peaks and troughs in the market.

What it is: Sequence of returns risk.

The danger that the timing of withdrawals from a retirement account, especially in the beginning coinciding with market downturns, can negatively impact the overall return and potentially deplete savings faster than expected.

Why it matters:

If poor investment returns occur early in retirement, when balances are typically larger, withdrawals can erode the capital more severely, potentially shortening the time your retirement savings will last.

You don't have to look too hard to see many more on the road behind us and it doesn't take a crystal ball to realize there will be more to come.

The only question is, will you ride the market down during your retirement with all the others or will you allow zero to be your hero?

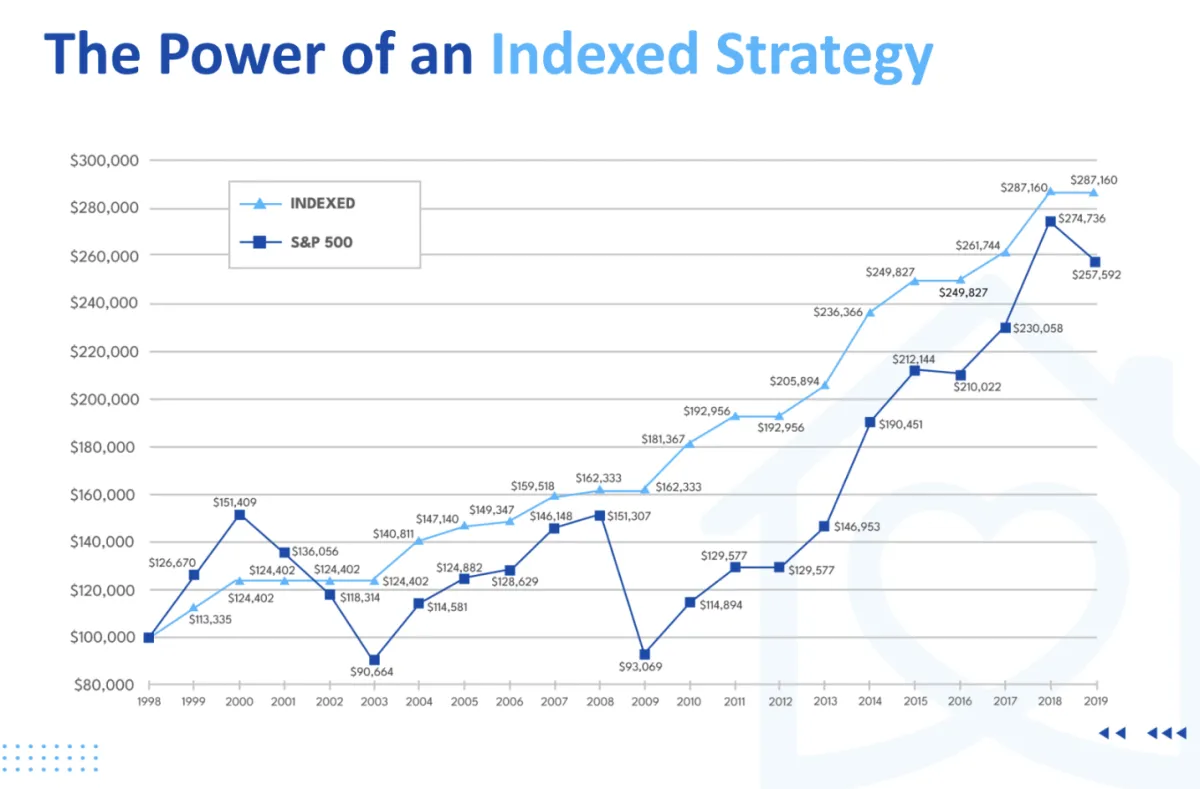

The Indexed Annuity Saves Most Retirements

From Ever Losing Money in The Market.

When you invest in an indexed annuity, you'll recieve all the upside on a positive S&P increase and protection from those S&P decreases.

While your money is gaining interest, if the market turns south, your returns will stop at a floor of 0% before any losses can occur.

PLUS...When you are ready to start taking income, you simply turn on the guarantee rider and your monthly distributions are locked in guaranteed for life! (Kinda like a "Win For Life" Lotto ticket)

What is an

Annuity?

An annuity is a financial contract that provides a steady stream of income during retirement, helping you manage your financial future. It allows you to convert your savings into reliable payments over time. Options include Fixed Annuities (guaranteed income), Variable Annuities (growth potential with market exposure), and Indexed Annuities (returns linked to a stock market index). Secure your retirement today with the right annuity plan.

Why You Need An Annuity?

Annuities provide financial security and peace of mind by ensuring a steady income during retirement.

Here are some reasons to consider getting an annuity:

Guaranteed Income

Annuities offer a reliable stream of income, helping you cover living expenses without worrying about outliving your savings.

Long-Term Care Planning

They serve as a cornerstone of your retirement strategy, providing predictable cash flow in the event expensive long-term care is needed to protect other retirement accounts still producing income.

Tax-Deferred Growth

With annuities, your investment grows tax-deferred, allowing you to maximize growth over time until you start making withdrawals.

Legacy Planning

Annuities can be structured to include benefits for your beneficiaries, ensuring your loved ones are financially secure even after you're gone.

Protection Against Market Fluctuations

Indexed and fixed annuities offer protection from market volatility, providing stability even during economic downturns.

Why Do You

Need Annuities?

Annuities provide financial security and peace of mind by ensuring a steady income during retirement. Here are some reasons to consider getting an annuity:

Guaranteed Income

Annuities offer a reliable stream of income, helping you cover living expenses without worrying about outliving your savings.

Long-Term Care Planning

They serve as a cornerstone of your retirement strategy, providing predictable cash flow in the event expensive long-term care is needed to protect other retirement accounts still producing income.

Tax-Deferred Growth

With annuities, your investment grows tax-deferred, allowing you to maximize growth over time until you start making withdrawals.

Legacy Planning

Annuities can be structured to include benefits for your beneficiaries, ensuring your loved ones are financially secure even after you're gone.

Protection Against Market Fluctuations

Indexed and fixed annuities offer protection from market volatility, providing stability even during economic downturns.

How It Works

Planning for a stable income during retirement doesn’t have to be complicated. Here’s how we make it simple:

1. Schedule a Discovery Session

Provide a few details, and we’ll do a short educational session that shows you how this all works to fit your plan. There is nothing to purchase during this session since we just want to find out if an annuity is a good fit for you.

2. Choose Your Plan

Choosing the right annuity that fits your specific situation and financial goals, is the next step. We will run a few illustrations to present to you next.

3. Rest Easy

Once we establish the right product, we'll move forward with the application and transfer of funds. Feel secure knowing that your retirement income is guaranteed, no matter what the future holds.

With a few easy steps, you can secure your financial future and enjoy the retirement lifestyle you deserve.

Why Choose Us?

Your financial future deserves security, and we make it easier than ever to achieve a stable retirement with the right annuity.

Flexible Income Options

Choose a plan that aligns with your retirement goals, whether you prefer guaranteed payments or growth potential.

I Promise to Treat You Like I was Setting This Up For a Family Member.

I take your retirement very serious and would NEVER recommend or move money for you unless I whole heartedly knew that it will enhance your life.

Tailored Solutions

Customize your annuity to suit your financial needs, ensuring peace of mind for the years ahead.

Start today and gain the confidence that comes with knowing your financial future is secure.

Why Choose Us?

Planning for a stable income during retirement doesn’t have to be complicated. Here’s how we make it simple:

Flexible Income Options

Choose a plan that aligns with your retirement goals, whether you prefer guaranteed payments or growth potential.

Quick, Hassle-Free Process

Get started in just minutes, with simple steps to secure your annuity. No lengthy paperwork required for most plans.

Tailored Solutions

Customize your annuity to suit your financial needs, ensuring peace of mind for the years ahead.

Start today and gain the confidence that comes with knowing your financial future is secure.

How It Works

Planning for a stable income during retirement doesn’t have to be complicated. Here’s how we make it simple:

1. Get a Quote

Provide a few details, and we’ll find the annuity options that best suit your needs.

2. Choose Your Plan

Choose the annuity that fits your budget and financial goals, with flexible payment and income options.

3. Rest Easy

Feel secure knowing that your retirement income is guaranteed, no matter what the future holds.

With a few easy steps, you can secure your financial future and enjoy the retirement lifestyle you deserve.

More Info

Important Questions

What Type of Annuity is Right for Me?

There are several types of annuities, including fixed, variable, and indexed annuities. The best choice depends on your financial goals, risk tolerance, and the level of income predictability you prefer. Fixed annuities provide guaranteed payments, while variable and indexed annuities have returns that can vary based on market performance.

How Much Should I Invest in an Annuity?

The amount to invest in an annuity depends on your retirement goals, existing savings, and anticipated expenses. It’s essential to ensure your investment balances your need for growth and your need for guaranteed income during retirement.

Can I Customize My Annuity Plan?

Yes, annuities can be tailored to fit your needs. You can choose options like adding a death benefit, selecting a guaranteed payment period, or even setting up joint annuities for you and your spouse. Customization allows you to align your annuity with your retirement strategy.

What Happens If I Need Access to My Money Early?

Withdrawing funds from an annuity early may incur penalties, especially within the surrender period. However, many annuities offer options for penalty-free withdrawals under specific circumstances, such as severe illness or a percentage of the account value each year.

How do I Sign Up?

For personalized assistance, book an appointment with me. I’ll guide you through the different types of annuities, help determine the best fit for your retirement plan, and ensure you make an informed decision. Schedule your free consultation today to secure your financial future.

More Info

Important Questions

What Type of Annuity is Right for Me?

There are several types of annuities, including fixed, variable, and indexed annuities. The best choice depends on your financial goals, risk tolerance, and the level of income predictability you prefer. Fixed annuities provide guaranteed payments, while variable and indexed annuities have returns that can vary based on market performance.

How Much Should I Invest in an Annuity?

The amount to invest in an annuity depends on your retirement goals, existing savings, and anticipated expenses. It’s essential to ensure your investment balances your need for growth and your need for guaranteed income during retirement.

Can I Customize My Annuity Plan?

Yes, annuities can be tailored to fit your needs. You can choose options like adding a death benefit, selecting a guaranteed payment period, or even setting up joint annuities for you and your spouse. Customization allows you to align your annuity with your retirement strategy.

What Happens If I Need Access to My Money Early?

Withdrawing funds from an annuity early may incur penalties, especially within the surrender period. However, many annuities offer options for penalty-free withdrawals under specific circumstances, such as severe illness or a percentage of the account value each year.

How do I Sign Up?

For personalized assistance, book an appointment with me. I’ll guide you through the different types of annuities, help determine the best fit for your retirement plan, and ensure you make an informed decision. Schedule your free consultation today to secure your financial future.

Looking for a First-Class Annuity Consultant?

Looking for a First-Class Annuity Consultant?

Crawford Health Group is committed to serving you at the highest level with all your Annuity needs.

National Producer Number: 19217432

Company

Directories

Legal

Crawford Health Group is committed to serving you at the highest level with all your Annuity needs.

National Producer Number: 19217432

Company

Directories

Legal